The earth beneath our feet is always evolving but the man-made disaster – read, lack of planning and poor forest management - that struck our community 13 months ago has truly shifted the landscape in Santa Rosa. Land is valued in many different capacities for not only its location, but its composition. The proximity of land to a desired place creates value while the underlying component or natural resource that exists below it may bring even greater worth: water, oil, gold, diamonds and so forth. The scale of a property impacts its’ use and capabilities as does the maltreatment of it by man-made deposits of toxins being left behind thereby rendering it not only temporarily unusable but also creating a costly liability. Some say the basis of all wealth is land, but the creativity brought to any particular plot will truly unlock its greatest potential.

According to BAREIS MLS, as October concluded, Sonoma County had exactly 519 non-commercial parcels on the open market - 68 of which were newly exposed to the market during the month. Sonoma County saw 50 sites receive accepted offers during the period while another 57 parcels formally traded hands – at a median value of $294,000 – well above the fifteen-year running average of 20 sales per month. This indicates a strong demand for appropriately priced parcels, though the increase in interest is overshadowed by the consistent supply of new lots being brought to the market as the chasm between sold and available properties widens.

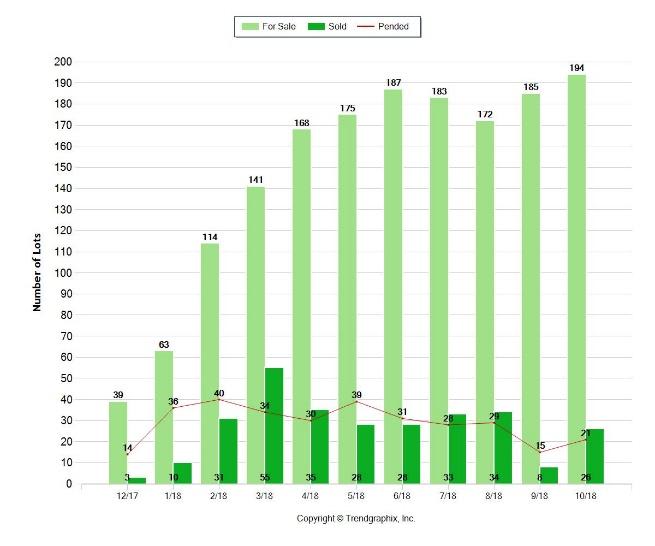

Specifically, within Sonoma County, Santa Rosa’s Northeast quadrant (see graph) has been the primary catalyst for the increased activity levels. Due entirely to what transpired last October, the Tubbs fire has reshaped the landscape and the marketplace as we know it. The region was showcasing 194 non-commercial parcels on the open market as we wrapped up October – well above the historical average of 14 lots at any given time. New offerings from sellers accounted for 36 of those during this period. October buyers captured 21 new contracts on parcels – well above the historical average of two per month - while sellers concluded 26 sales during the period thereby encouraging those with plans to sell there lots to bring them to market.

As the volume of offerings and transactions stack up we see measurable data points appear. In Northeast Santa Rosa, the average price paid for a lot in October was $394,000 while the median price hovered at $287,000 – median is the midpoint of all sold properties where by half sold for more while the other half sold for less.

In a market as liquid as we are encountering, even though the average number of days to sell a parcel has climbed to 107, the only thing keeping the dirt from transacting is the price being asked by the seller. This is a common theme in basic economics – a seller sets a price, but a buyer establishes the market value.

Less buoyant activity can be seen in Northwest Santa Rosa – the second most impacted by the fires where there are many fewer sellers than across town in Northeast Santa Rosa. October witnessed sellers adding only five new offerings while buyers in waiting placed seven lots into contract leaving 25 properties available to open with in November. The average price paid for dirt in this region during the month was $283,000 while the median value slid to its lowest level in twelve months at $166,000 – albeit on a sample size of only five sales being completed these metrics must be taken in an annual format rather than a monthly one to create a bankable measure.

Along with this, as more parcels make their way to market, another metric comes into play – the elasticity of demand. This is the measure of the change in the quantity demanded or purchased in a product – vacant land in this case - in relation to its price, or required adjustment of such, so that it finds a willing and capable buyer.

Each month adds to the charted progress within our markets as we anticipate values on lots to be more closely associated with the effective price of the newly built home that rises in its place. A rule of thumb typically used by investors is that not more than 15-20 percent of the value of the total combined asset can be assigned to the underlying cost of the dirt. Thus, for a $1,000,000 home, a builder or investor should be reluctant to pay more than $150,000 - $200,000 for the lot the home will sit on unless there cost to build is uncharacteristically below market metrics. With the rising costs of construction, these market forces may diminish the value a willing buyer may place on the parcel they are seeking – moving forward, expect lot prices for most sites to fall in line with market requirements before being transacted on.

Stay up to date on the latest real estate trends.

December 2025 Numbers